APR stands for Annual Percentage Rate. When understanding what the APR or annual percentage rate is its important to understand how it compares to the interest rate youll pay for your mortgage.

Apy Vs Apr And Interest Rates What S The Difference Ally

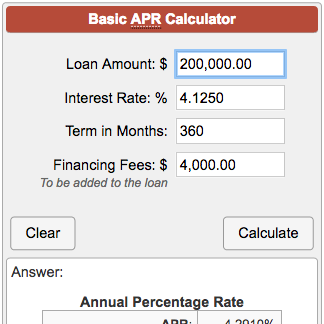

The APR assumes you will stay in your mortgage for the full term eg 30 years on a 30-year loan.

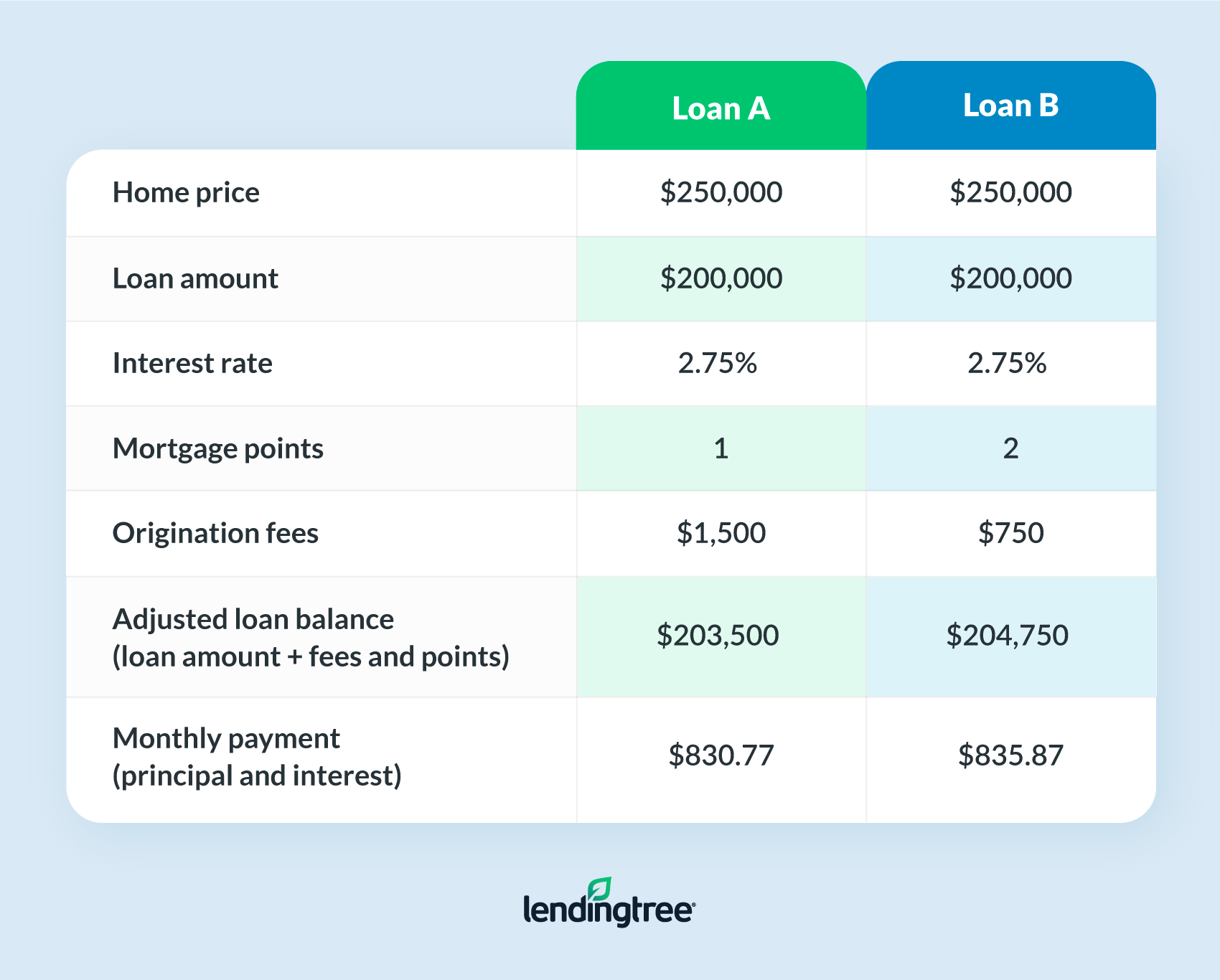

What does apr mean on a mortgage. APR is a combination of the interest and fees that lenders charge for originating a loan. When shopping for a loan home buyers do not have to do the math on their APR alone nor do they have to look far for it. If you plan on moving within a few years or youre thinking about refinancing after a certain time most likely the case if you have an adjustable-rate mortgage then it may make sense to pay fewer upfront fees and get a higher APR.

Lets say you borrow 10000 over 3 years to buy a car. Your interest rate is the percentage of a mortgage that the lender charges you for the privilege of letting you borrow the money. The MCD is European legislation designed to create a single market for.

Importantly it includes the standard fees and interest youll have to pay. Upfront PMI Private Mortgage Insurance Conventional Loans. An APR of 55 would include your annual interest rate.

In the case of loans and credit cards there tends to be a single interest rate the APR. The interest rate is the percentage you will pay to borrow the money for your home. APR is the annual cost of a loan to a borrower including fees.

Like an interest rate the APR is expressed as a percentage. Mortgage APR includes the interest rate points and fees charged by the lender. This rate does not reflect fees or any other charges associated with the loan but calculates what your actual monthly mortgage payment would be.

Our Mortgage APR is for fixed rate loans and does not give an accurate comparison of the costs on adjustable-rate mortgages ARMs because it cannot anticipate how the rate on the loan may change over time and does not take into account factors such as the frequency of rate changes and limits on how much rates may be adjusted which vary from loan to loan. What is mortgage APR. The annual percentage rate APR is the amount of interest on your total mortgage loan amount that youll pay annually averaged over the full term of the loanA lower APR could translate to lower monthly mortgage payments.

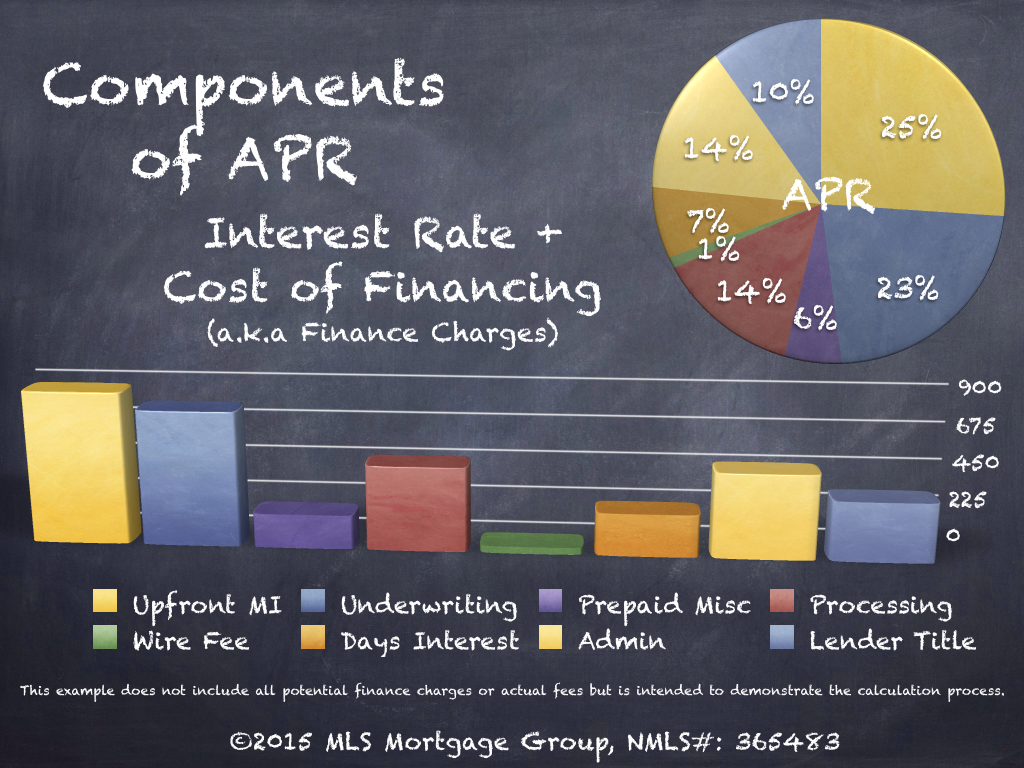

Youll see APRs alongside interest rates in todays mortgage rates. It includes the interest rate points fees and insurance on a mortgage. The APR reflects the annual cost of the loan including the interest rate plus other charges.

Its the annual rate charged for borrowing money. Youll see APRs alongside interest rates in todays mortgage rates. The annual percentage rate APR is the amount of interest on your total mortgage loan amount that youll pay annually averaged over the full term of the loan.

Its expressed as a. A lower APR could translate to lower monthly mortgage payments. Unlike an interest rate however it includes other charges or fees such as mortgage insurance most closing costs discount.

Mortgage Annual Percentage Rate Mortgage APR is the cost of the loan expressed as a percentage taking into account various loan charges of which interest is only one such charge. APR or Annual Percentage Rate refers to the total cost of your borrowing for a year. The APR on a credit product represents the amount of interest that youll pay annually for the amount borrowed and includes all compulsory fees.

Annual percentage rate or APR reflects the true cost of borrowing. Other charges which are used in calculation of the Annual Percentage Rate are as applicable. For that reason your APR is usually higher than your interest rate.

Annual Percentage Rates were introduced in the UK by the Consumer Credit Act 1974 and amended in 2006. Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage. That way the total cost will be less over the first few.

An annual percentage rate APR is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate any points mortgage broker fees and other charges that you pay to get the loan. APRC stands for Annual Percentage Rate of Charge and its something youll see on mortgage adverts and quotations from now on including MoneySuperMarkets mortgage tables.

APR fees are the additional costs incurred when getting a mortgage loan. This new bit of financial jargon that has arrived courtesy of the Mortgage Credit Directive MCD which came into effect on 21 March 2016. For mortgages there could be more than one interest rate the fixed rate and the variable rate.

What Is Apr Mortgage Apr Mls Mortgage

What Is Apr Mortgage Apr Mls Mortgage

What Is Apr And What Exactly Do You Need To Know Lexington Law

Apr Vs Interest Rate Why It S So Important The Lenders Network

Annual Percentage Rate Apr Definition And Meaning Market Business News

Apr Vs Interest Rate What S The Difference Lendingtree

What Is Apr Mortgage Apr Mls Mortgage

Mortgage Rate Vs Apr What To Watch For

What Is Apr Mortgage Apr Mls Mortgage

How To Calculate Annual Percentage Rate 12 Steps With Pictures

Apr Vs Interest Rate Guide What S The Difference Fortunebuilders

The Difference Between Apr And Interest Rate On A Mortgage Mortgagehippo

What Is Apr Annual Percentage Rate Bench Accounting

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law