Adjustable rate mortgages are variable and your APR may increase after the original fixed-rate periodMortgage Loan payment example. Additionally if you choose a conforming or a Jumbo HomeBuyers Choice or Military Choice loan youll be subject to a funding fee of 175 of the loan amount.

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Table of the difference in total cost in todays dollars for both the shorter term and longer term loans.

Current mortgage rates navy federal. See the latest actual rates home-owners were offered at Navy Federal Credit Union. A fixed-rate loan of 250000 for 30 years at 2750 interest and 2887 APR will have a monthly payment of 1020. Navy Federal Current Mortgage Rates It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition.

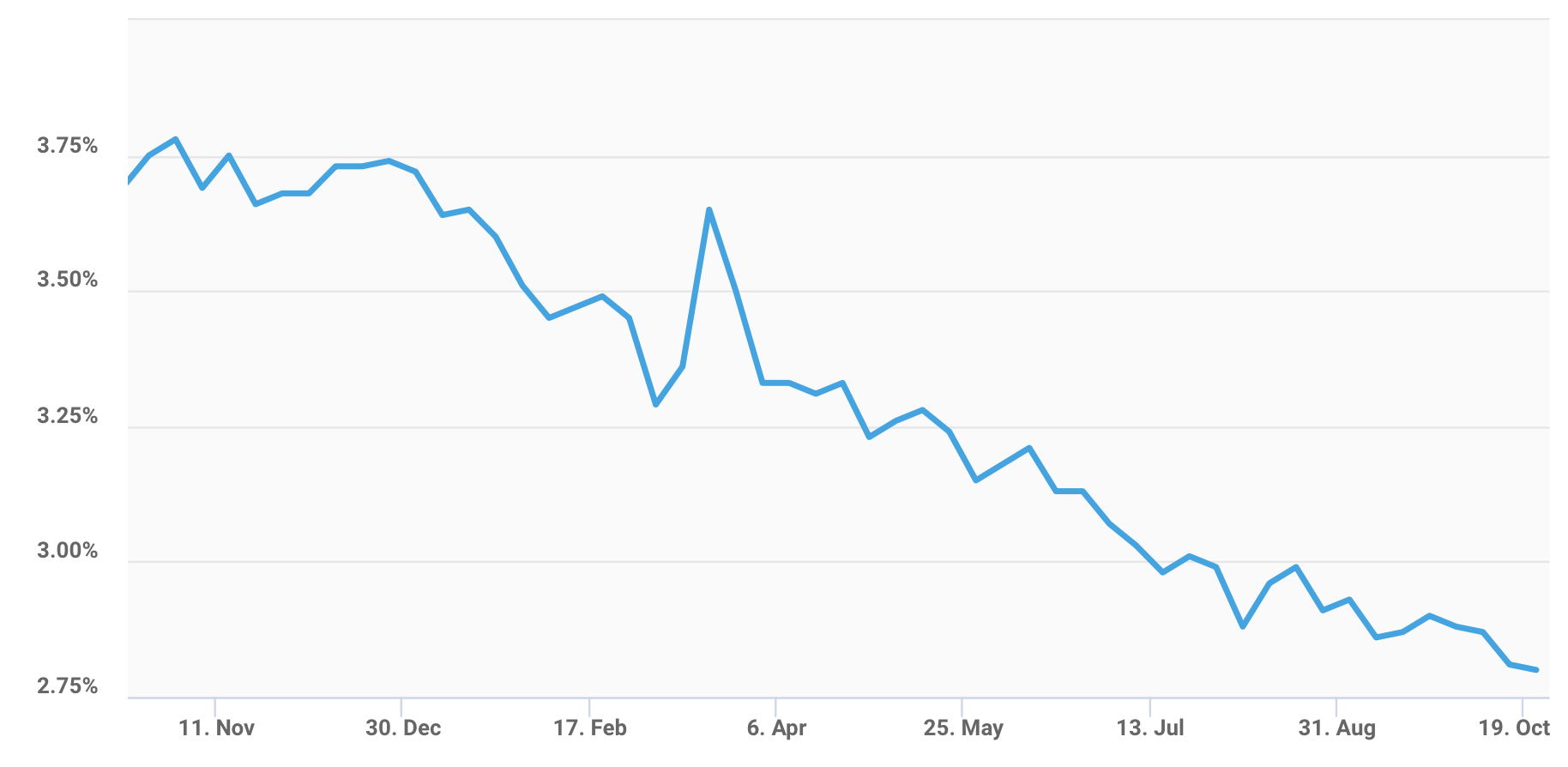

How much will a Navy Federal Credit Union mortgage cost. 15 year conforming mortgage rates are currently advertised at 425 percent with 075 mortgage points. On the week of November 5th the average 30-year fixed-rate fell to 278.

Other fees are listed on your loan estimate and can include origination fees or funding fees. Taxes and insurance not included. Navy Federal Current Mortgage Rates Applying for a home equity loan is similar but easier than applying for a new mortgage.

This rate offer is effective 06282021 and subject to change. This type of loan is available to anyone who owns their property. The 15-year loan will cost you 9788 less in todays dollars over the 7 years.

Rates quoted above require a 100 loan origination fee. 30Yr Super Conforming 4875 rate with 125 points. 15Yr Conforming 4375 rate with 025 points.

Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans. Even if you are eligible for a specialty credit union like Navy Federal its worth comparing how a national bank stacks up. 30Yr Conforming 4750 rate with 125 points.

Rates are based on creditworthiness loan-to-value LTV occupancy and loan purpose so your rate. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609. Maximum loan amounts for VA loans are determined by property location.

This loan also has an origination fee of 1 which can be waived for a 025 interest rate. A fixed-rate loan of 250000 for 15 years at 2125 interest and 2338 APR will have a monthly payment of 1623. Navy Federal takes a monetary incentivization stance they offer a 1000 mortgage rate match program.

If you are currently a Wells Fargo customers you may be eligible for a. 30Yr Conforming 4865 rate with 025 points. Mortgage Rates View All Navy Federal Credit Union.

A fixed-rate loan of 250000 for 15 years at 1875 interest and 2086 APR will have a monthly payment of 1594. 30Yr Super Conforming 500 rate with o25 points. Navy Federal does not charge application fees.

Navy Federal Credit Union NFCU Mortgage shows its current mortgage loan rates on its website. A Navy Federal Credit Union loan review should note there is a 1 loan origination fee. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1608.

The origination fee may be waived for a 025 increase in the interest rate. How Does a Home Equity Loan Work. A fixed-rate loan of 250000 for 15 years at 2000 interest and 2212 APR will have a monthly payment of 1609.

Navy Federal Credit Union vs. Current fixed conforming 30 year mortgage rates are being advertised at 475 with 125 mortgage discount points or 500 with 025 mortgage points. All VA loans are subject to.

2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and refinance loans contributing 27 to the total. Navy Federals website displays sample interest rates for most of the mortgages it offers along with annual percentage rates. Taxes and insurance not included.

For example Military Choice Loans include a funding fee of 175 of the loan amount that can be financed into the loan or waived for a 0375 interest rate increase. You can also see monthly payment examples for. The origination fee may be waived for a 025 increase in the interest rate.

As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows. Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans. Here are current mortgage rates at Navy Federal Credit Union.

That transparency can. Any home owner can apply for a home equity loan. If youre refinancing a mortgage with a non-NFCU loan then youre subject to a 0750 higher rate.

Rates quoted above require a 100 loan origination fee. A VA loan of 250000 for 30 years at 2125 interest and 2471 APR will have a monthly payment of 939. Find that the advertised and actual refinance mortgage rates are different.

Nfcu mortgage rates calculator. Terms fees and discounts on Navy Federal Credit Union mortgages depend on the product. Its detailed mortgage rate and fee sheet is public and extremely informative.

For primary residences and second homes only. A sample principal and interest monthly loan payment on a 250000 fixed-rate loan at 5237 APR for 30 years is 136122. 15Yr Conforming 4250 rate with 075 points.

A fixed-rate loan of 250000 for 30 years at 2500 interest and 2635 APR will have a monthly payment of 987.

When Does It Make Sense To Refinance A Mortgage Navy Federal Credit Union

Credit Union Mortgages Worth It Or Not Rethority

California Mortgage Rate For Forecast 2021 A Three Percent Kind Of Year

Navy Federal Credit Union Personal Loan Review Long Terms And Large Loans For Members Valuepenguin

San Diego Mortgage And Real Estate Why San Diego Veterans Choose Me Over Navy Federal Credit Union For Va Home Loans

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Nasa Mortgage Quote Myfico Forums 5529297

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Mortgage Comparison Calculator Navy Federal Credit Union

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Navy Federal Credit Union Mortgage Review 2021 Us News

Conventional Fixed Rate Mortgages Navy Federal Credit Union

Conventional Fixed Rate Mortgages Navy Federal Credit Union

The Mortgage Refinance Process Navy Federal Credit Union

Mortgage Comparison Calculator Navy Federal Credit Union

When Does It Make Sense To Refinance A Mortgage Navy Federal Credit Union