Equation for mortgage payments. Other associated costs may include property taxes home insurance and mortgage insurance.

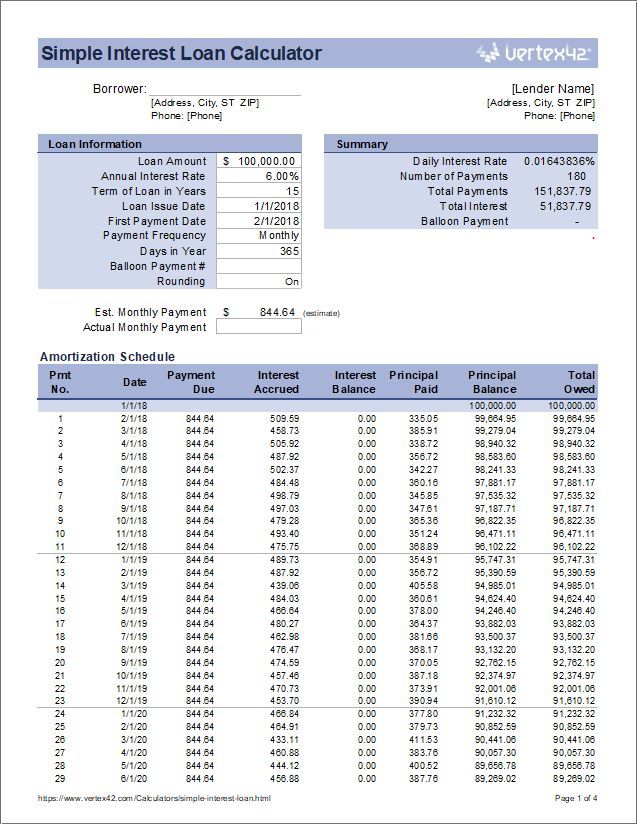

Download The Simple Interest Loan Calculator From Vertex42 Com My Amortization Simple Mortgage Calcula Amortization Schedule Simple Interest Loan Calculator

Those who rent ultimately pay this expense as part of their rent as it is reflected in their rental price.

Mortgage payment interest. Increases in market rates and other factors cause interest rates to fluctuate which changes the amount of interest the borrower must pay and therefore changes the total monthly payment due. After that period youll need to pay principal and interest which means your payments will be significantly higher. Its important to consider the overall mortgage costs not just the monthly payment amount.

Your mortgage payment is the same every month unless your interest rate changes but the parts of your mortgage payment that goes toward your principal and interest charges changes the longer you have the mortgage. M Pr1rn1rn-1 M the total monthly mortgage payment. Shows the cost per month and the total cost over the life of the mortgage including fees interest.

Interest on your mortgage is generally calculated monthly. APR is the amount of interest that you pay. So lets say you complete on the 10th.

Your mortgage lender typically holds the money in the escrow account until those insurance. P the principal loan amount. It does not provide.

A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. One cant simply look at the old property tax payment. Interest payments are front-loaded early on and are gradually reduced until principal payments start to exceed them.

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. In some cases borrowers may put down as low as 3. You usually need to be getting.

The second major part of your monthly mortgage payment is interest. This bring you closer to home ownership stability and grants you further life flexibility. If the borrowers make a down payment of less than 20 they will be required to pay private mortgage insurance PMI.

If a home buyer opts for a 30-year loan most of their early payments will go toward interest on the loan. It also means you have less capital to pay off at the end of the term than you would if youd have taken out a purely interest-only mortgage. Typically mortgage lenders want the borrower to put 20 or more as down payment.

In contrast interest-only payments do not build equity. Its paid as a loan which youll need to repay with interest when you sell or transfer ownership of your home unless youre moving the loan to another property. Your bank will take the outstanding loan amount at the end of each month and multiply it by the interest rate that applies to your loan then divide that amount by 12.

However compared to a full repayment mortgage you immediately build equity in your home. If you have an escrow account you pay a set amount toward these additional expenses as part of your monthly mortgage payment which also includes your principal and interest. Thats because the first payment will include an initial interest payment covering the interest for the days between the date you complete on the house and the end of that month.

R your monthly interest rate. This is the local rate home owners are charged to pay for various municipal expenses. Most lenders calculate interest in terms of an annual percentage rate APR.

Its worth remembering that your first mortgage payment will usually be much larger than your regular monthly repayment. You can make principal payments during the interest-only period but youre not required to. Adjustable-rate mortgages ARMs come with interest rates that can and usually do change over the life of the loan.

For most borrowers the total monthly payment sent to your mortgage lender includes other costs such as homeowners insurance and taxes. Extra payments applied directly to the principal early in the loan term can save many years off the life of the loan. Interest is money you pay to your mortgage lender in exchange for giving you a loan.

With adjustable rate mortgages the interest rate is set to be reviewed and. Part repayment and part interest-only mortgages can be an ideal option for those with a valid repayment plan wanting lower monthly payments than youd expect from a conventional repayment mortgage. What is an interest-only mortgage.

Borrowers will find interest-only payments affordable.

Mortgage Calculator 2019 How To Use The Monthly Payment Formula For Mor Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Refinance Calculator

Mortgage Calculator Calculate You Montly Payments On Your Mortgage How Much Interest Will You P Mortgage Payment Calculator Mortgage Tips Mortgage Calculator

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Tips

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Mortgage Calculator Monthly Payments Screen Mortgage Loan Originator F Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Cnn Mortgage Calc Mortgage Calculators Instantly Calculate Your Monthly And Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization

Mortgage Calculator Mortgage Amortization Mortgage Estimator Mortgage Calculator

Mortgage Payments Chart Sell Annuity Payments Mortgage Info Mortgage Payment Pay Off Mortgage Early

Mortgage Calculate App By Erlangga Maulana Amortization Calculator Amortizati Mo0 Mortgage Loan Calculator Online Mortgage Mortgage Amortization Calculator

Mortgage Calculator Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Mortgage Amortization Amortization Schedule

Mortgage Payment Calculator Loan Amount 175000 Interest Rate 2 5 Loan Term 25 Years Mortgage Payment Mortgage Payment Calculator Loan Amount

Download The Simple Interest Loan Calculator From Vertex42 Com Mo0rtgage Calcula Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

Mortgage Calculator Excel 5 Mortgage Calculators Instantly Calculate Your Mo Mortgage Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Exploration Mortgage Calculator In 2021 Mortgage Calculator Mortgage Calculator App Calculator Design

Dribbble Show And Tell For Designers Chart Finance App Equity

A Helpful Chart To Determine What Your Mortgage Payment Will Be At Different Interest Rates And Loan Amounts Homeowner Hacks Mortgage Payment Home Ownership

Mortgage Calculator Mortgage Calculator Excel Mortgage Loan Calculator And Amortization Schedule Mortgage Loan Calculator Mortgage Loans Mortgage Amortization